Derivatives Valuation in Practice

These papers provide practical case studies based on our experience helping clients implement SOFR derivative valuations, transition away from LIBOR, and go through central clearing.

|

SOFR Spotlight Group on LinkedIn Join Group We invite you to join the conversation in our SOFR and LIBOR-Transition group on LinkedIn. It's a place to discuss the key components of the interest-rate derivatives market’s adoption of SOFR: market data, curves, valuations, models, LIBOR fallbacks, and effectiveness testing for swaps and other derivative products. It's open to a broad range of participants and we keep it sales & marketing free. |

|

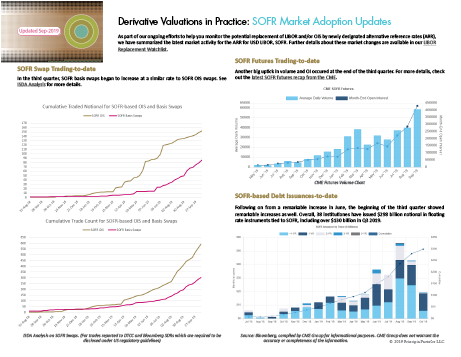

Updates: SOFR Market Adoption Mar 2020 - Download A quick summary of SOFR-based interest rate trades (debt issuances, swaps, futures). Provides at-a-glance indication of the how the SOFR market is growing. |

|

Watchlist: LIBOR Replacement Sep 2019 - Download Updated from our original watchlist published November 2017, see the latest developments to our list of what to watch and prepare for as LIBOR is reformed and alternative rates are published. Covers the questions to ask (and answer) to ensure you’ve thought through all the ways changes to LIBOR could impact your business. |

|

The impact of OIS discounting on curves in a multi-curve world Part 2 | Derivatives Valuation in Practice Download A technical paper examining the subtleties of dual curve calibration and implementing OIS discounting in LIBOR, tenor and basis curve calibration. In a world where accurate, independent valuation demands the implementation of a multi-curve environment, how must OIS discounting be applied across the spectrum of curves to ensure pricing that reflects the dealer market? |

|

Market drivers for multi-curve pricing: Supplementary data Part 1a | Derivatives Valuation in Practice Download Provides additional data to support the analysis and understanding of the multi-curve environment now and across the pre-, peak- and post-credit crisis environments. The paper highlights the behavior over time of OIS vs LIBOR tenor spreads and tenor basis swap spreads of various maturities. |

|

Market drivers for multi-curve pricing and OIS discounting Part 1 | Derivatives Valuation in Practice Download An introduction to multi-curve pricing, OIS discounting and new derivatives valuation standards by Dr. Douglas Long, EVP Product Strategy. “Even as the market settles into a new norm of tightening spreads, the consequences of these changes are subtle and involved - and in some cases more material now, than even at the peak of the crisis”. |

|

Checklist: Have you got all your OIS bases covered? Download A checklist to help clients implement OIS discounting. Covers the questions to ask (and answer) to ensure you've thought through all the ways OIS Discounting can materially impact your business. |

Know Your Derivatives

A web-based derivative portfolio

management, risk and operational

platform.

SOFR curve and volatility integration

allows users to perform and analyze: