Articles

The following is a collection of reecent market research articles and contributed editorial features by Principia which can be linked to below:

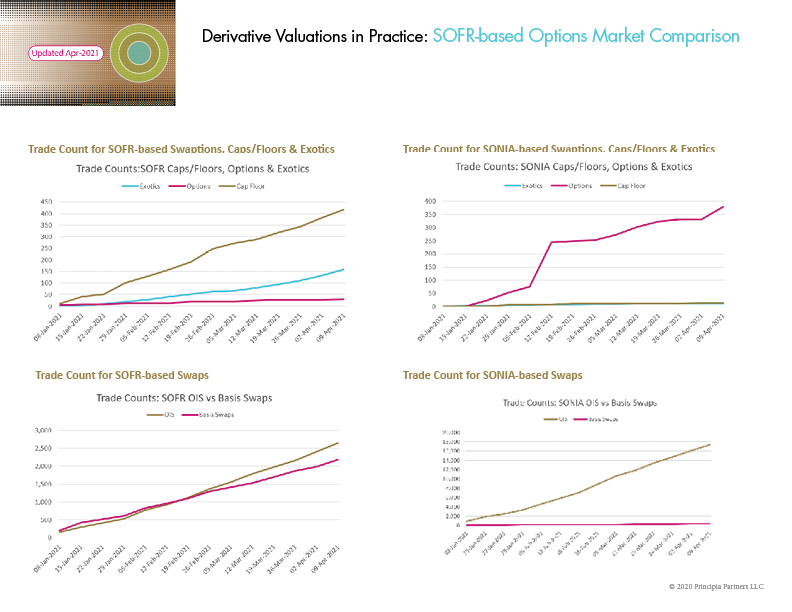

| Apr-21 | Trading Trend for SOFR-based Option Products

At long last, trading volumes for SOFR-based caps and floors seems to be gaining some momentum though other SOFR-based options are picking up at a much slower pace. Comparing these volumes to the SONIA in the UK, it is evident that there is still a very long way to go, however. |

|

| Mar-20 | Update: SOFR Market Adoption

SOFR basis swaps have begun to overtake SOFR OIS swaps but this seems to be due to traded notional, not trade count. In addition to SOFR futures options now trading on the CME, the first two SOFR Swaptions have also traded. |

|

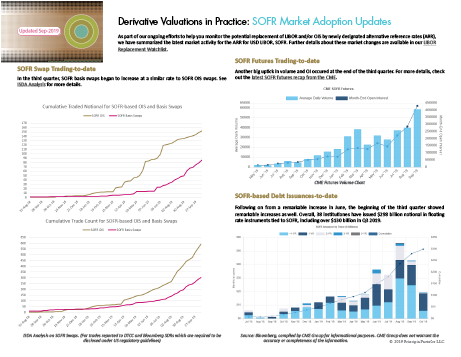

| Sep-19 | Update: SOFR Market Adoption

SOFR-based OIS trading continued strong growth in the third quarter and SOFR basis swaps began to keep pace. |

|

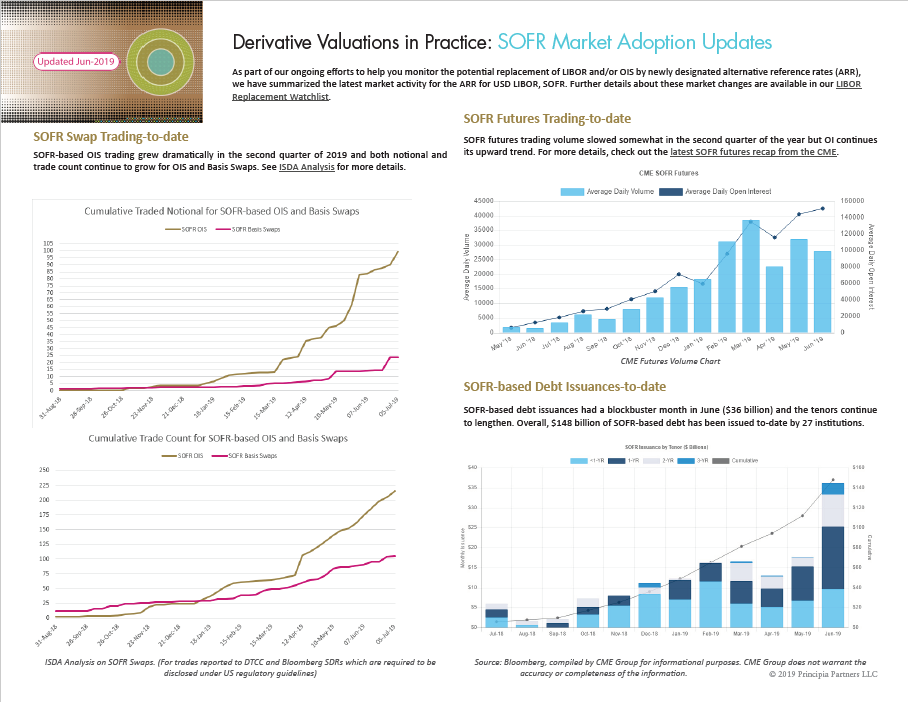

| Jun-19 | Update: SOFR Market Adoption

SOFR-based OIS trading took off at the end of the second quarter and looks likely to continue growth in the third quarter. |

|

| May-19 | Updated Watchlist for LIBOR Replacement

The CME is supporting discussions around a "big bang" transition to discounting with SOFR instead of EFFR and the ARRC has released recommended fallback language for FRNs and Syndicated Loans. |

|

| Mar-19 | Principia Now Offering a Comprehensive Solution for SOFR Derivatives Principia has announced the full integration of SOFR into their platform, Principia SFP, and the online derivatives valuation service powered by it, pasVal. |

|

| Mar-19 | Update: SOFR Market Adoption

SOFR issuances, futures, and swaps took off in the new year. |

|

| Mar-19 | Updated Watchlist for LIBOR Replacement

SOFR-based issuance in February 2019 was 25% of total issuance to-date (16.4B out of 65B since July 2018) and CME SOFR futures trading nearly doubled in both volume and open interest from January to February 2019. |

|

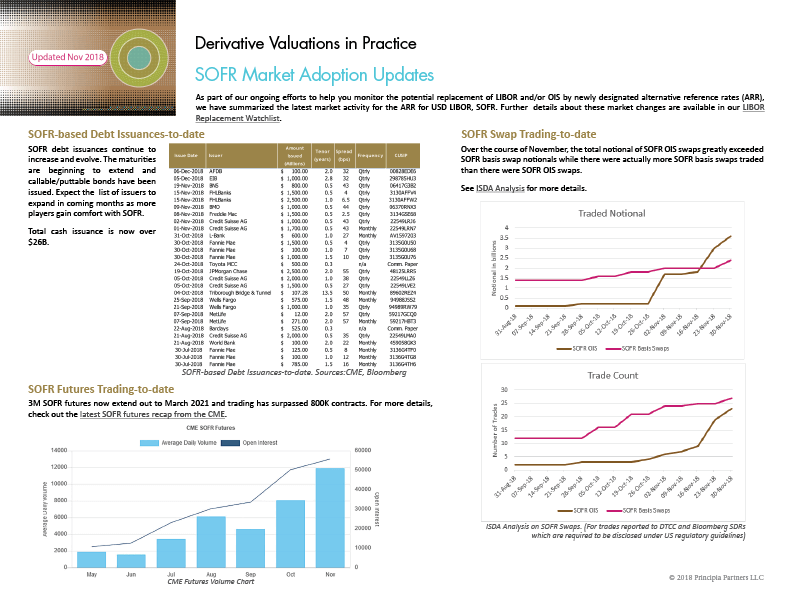

| Dec-18 | Update: SOFR Market Adoption

SOFR issuances, futures, and swaps all significantly increased trading in October and November 2018. |

|

| Nov-18 | Updated Watchlist for LIBOR Replacement

In November, ISDA announced a preliminary fallback methodology while SOFR-based issuances and swaps continued to grow and the ECB discontinued 2W, 2M and 9M tenors of EURIBOR. |

|

Nov-18 | Principia Offers SOFR Impact Assessments with pasVal

Principia announced its new service: impact assessments for the US market transition away from LIBOR to replacement, SOFR. |

|

| Oct-18 | Updated Watchlist for LIBOR Replacement

FASB makes SOFR an eligible benchmark and SOFR swaps are cleared on the CME. |

|

| Sep-18 | Updated Watchlist for LIBOR Replacement

SOFR-based debt issuances and swaps continue to grow, and the ARRC requests consultation for fallback language. |

|

| Sep-18 | SOFR Derivatives Now Available with pasVal Principia announced the launch of its feature set to fully capture and value SOFR derivatives via subscription to their monthly online valuation service, pasVal. |

|

| Aug-18 | Updated Watchlist for LIBOR Replacement

New strides in market acceptance of SOFR with the first debt issuances and swaps entering the market. The pace is picking up - get the latest updates. |

|

| Jul-18 | Updated Watchlist for LIBOR Replacement

ISDA urges immediate action and publishes checklist. SOFR swaps begin trading. Get the latest market developments for replacements to LIBOR. |

|

| May-18 | Updated Watchlist for LIBOR Replacement

SOFR futures have begun trading and SONIA futures will follow in June. Get the latest market developments for replacements to LIBOR. |

|

| Apr-18 | Updated Watchlist for LIBOR Replacement

The proposed USD LIBOR replacement, SOFR, has begun publication and we've updated our watchlist with all the latest news. |

|

| Feb-18 | Updated Watchlist for LIBOR Replacement

We've updated our watchlist with the latest market events related to LIBOR reform and replacement. |

|

| Nov-17 | Watchlist for LIBOR Replacement

We've prepared a handy watchlist to help you get ready as alternative benchmarks to LIBOR enter the market. |

|

| Feb-16 | GASB 53 Reporting and Effectiveness Testing Made Easy with pasVal

Principia announced GASB 53 reporting and hedge effectiveness tests are now available through its derivatives valuation service, pasVal. |

|

| Dec-15 | Straightforward OIS Discounting Impact Assessment with pasVal

Principia announced OIS discounting impact assessments are now available through its derivatives valuation service, pasVal. |

|

| Oct-15 | Principia Makes Complex Valuations More Accessible With pasVal

Principia announced the launch of its portfolio valuation, risk, and accounting management service, pasVal. |

|

| Jan-15 | Principia Offers New Services for Easier DFAST Reporting

The new service will be available for use in performing DFAST (Dodd-Frank Act Stress Testing) valuations for baseline, adverse, and severely adverse scenarios. |

|